A Strategic Guide to Selecting Secure Accounting Software

Foundational Principles of Secure Financial Management

In 2025, financial data is no longer just a business asset; it has become a primary target for sophisticated cyber threats. Protecting this information is now a matter of corporate governance, not merely an IT department task. This shift requires a fundamental change in how we approach financial management, moving from a reactive security posture to a proactive, strategic one.

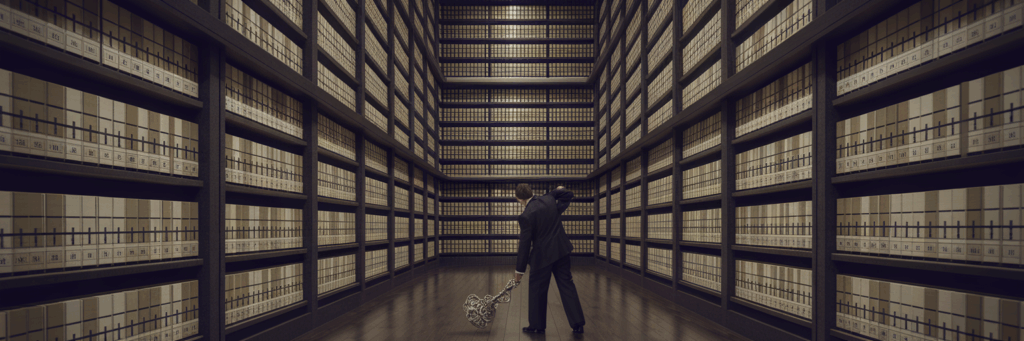

This is where a privacy-first approach becomes essential. Unlike basic security measures that bolt on protections after the fact, a privacy first accounting platform is built with data protection at its core. It operates on principles like data minimization, collecting only what is necessary, and ensures that you, the user, maintain full control and ownership of your data. It’s the difference between putting a lock on an existing door and designing a fortress from the ground up.

Adhering to these principles directly impacts stakeholder trust. When customers, investors, and partners see a transparent commitment to security, evidenced by compliance with standards like GDPR, their confidence grows. This trust is not a byproduct of good business; it is a cornerstone of it, safeguarding your reputation and ensuring long-term loyalty in an increasingly data-conscious world.

Evaluating Core Security and Privacy Architecture

With the strategic importance of privacy established, the next step in learning how to choose accounting software is to examine the technical architecture that underpins its security claims. A truly secure system is built on several non-negotiable pillars that you can verify.

- Zero-Knowledge Architecture: This is the highest standard for data privacy. In a zero-knowledge system, the service provider has absolutely no access to your unencrypted data. You hold the only key. This means that even in the event of a server breach, your financial information remains unreadable and secure. Platforms built on a zero-knowledge framework are designed to deliver this ultimate level of security.

- Comprehensive Encryption: Data must be protected at all times. This requires two forms of encryption working together. End-to-end encryption protects your data while it is in transit between your device and the server. At-rest encryption secures your data when it is stored on the server. Both are essential business data encryption standards for a complete defense.

- Multi-Factor Authentication (MFA): Think of MFA as a mandatory second line of defense. It requires users to provide two or more verification factors to gain access, significantly reducing the risk of unauthorized entry even if a password is compromised. It should not be an optional feature but a baseline requirement.

- Independent Security Audits: A provider’s security claims should never be taken at face value. Reputable platforms voluntarily undergo rigorous audits by independent third parties to validate their security and compliance. For example, solutions like NetSuite OneWorld are built to provide extensive security features tailored for global businesses, including robust data encryption and compliance with international standards. These audits provide objective proof of a platform’s integrity.

Assessing Customization and Future-Proof Scalability

Beyond robust security, a platform’s value is determined by its ability to adapt to your unique operational needs and grow with your business. A rigid system, no matter how secure, will eventually create friction, inefficiencies, and hidden costs. True operational excellence comes from software that conforms to your processes, not the other way around.

Tailored Financial Reporting

Your business communicates with different stakeholders, from internal department heads to external investors, and each requires a different financial story. A superior accounting platform allows you to move beyond generic templates and create bespoke reports that highlight the specific metrics relevant to each audience, providing clarity and enabling better decision-making.

Adaptable Workflows and Invoicing

Does your software dictate your invoicing and expense approval process? It shouldn’t. The right platform offers adaptable workflows, allowing you to design custom invoicing templates, set up multi-stage approval chains, and automate processes in a way that mirrors your actual business operations, saving time and reducing manual errors.

Granular Access Controls

Not every team member needs access to all financial data. We can all recall the slight unease of giving a new employee broader permissions than necessary. Granular access controls solve this by allowing you to define user-specific permissions. You can restrict access to sensitive reports or limit actions to specific roles, minimizing internal data risks and ensuring employees only see the information they need to perform their jobs.

Built-in Scalability

Your business plans to grow, and your accounting software must be ready for it. A scalable platform can handle a significant increase in transaction volume, users, and data complexity without any decline in performance. This foresight prevents the costly and disruptive process of migrating to a new system when you outgrow your current one.

Verifying Global Currency and Compliance Capabilities

For businesses operating across borders, managing international finance introduces significant complexity. The right secure accounting software for business transforms these challenges into a streamlined, automated process. When evaluating multi currency accounting solutions, there are several critical capabilities to verify.

- Multi-Currency Transactions: The platform must allow you to effortlessly invoice clients and receive payments in their local currencies, eliminating friction in the sales process.

- Automated Gain and Loss Calculation: Fluctuating exchange rates create realized and unrealized gains or losses. The software should handle these calculations automatically, ensuring your financial statements are always accurate.

- Real-Time Exchange Rates: Access to up-to-the-minute exchange rates is crucial for accurate financial reporting and forecasting. Manual rate lookups are inefficient and prone to error.

- International Tax Management: The system should simplify the management of diverse tax regulations, such as VAT, GST, and other local sales taxes, reducing the compliance burden.

- Consolidated Financial Reporting: If your business has multiple international entities, the ability to consolidate financial data into a single, unified report is essential for a clear overview of global performance.

- Unalterable Audit Trails: For cross-border transactions, a clear and unchangeable audit trail is non-negotiable for compliance and transparency.

Modern accounting platforms like ours are designed to handle these complexities, turning what was once a manual, error-prone task into a core strength. As industry observers like Wise highlight, the best accounting automation software is increasingly focused on streamlining these complex international processes.

A Practical Framework for Platform Comparison

Choosing the right platform is a strategic decision that requires a structured evaluation. Instead of getting lost in feature lists, use a practical framework to guide your comparison. Start with hands-on testing through free trials and product demos to assess usability and determine if the interface feels intuitive for your team. Next, evaluate its integration capabilities. Your accounting software does not exist in a vacuum; it must connect seamlessly with your CRM, e-commerce platform, and other essential systems to create a unified data ecosystem.

Pay close attention to the quality of customer support. When a technical or security question arises, you need access to expert assistance, not just a generic help desk. Finally, look beyond the monthly subscription fee and consider the Total Cost of Ownership (TCO). This includes one-time costs for implementation, data migration, and employee training, giving you a realistic view of the long-term investment.

| Evaluation Criterion | Key Questions to Ask | Why It Matters for Your Business |

|---|---|---|

| Security & Privacy Architecture | Does it use zero-knowledge architecture? Is data encrypted both in transit and at rest? Are third-party audits available? | Protects your most critical financial data from breaches and ensures you maintain full data ownership. |

| Customization & Flexibility | Can I create custom reports? Can workflows be adapted to our processes? Are access controls granular? | Ensures the software supports your unique operations, improving efficiency and reducing internal risks. |

| Global Capabilities | Does it support multiple currencies? Does it help manage international tax compliance? Can it consolidate reports? | Reduces the complexity and risk of error in cross-border financial management. |

| System Integrations | Does it connect seamlessly with our CRM, e-commerce, or other essential tools? Is there a well-documented API? | Creates a unified data ecosystem, eliminates data silos, and automates information flow across the business. |

| Total Cost of Ownership (TCO) | What are the costs beyond the subscription, including implementation, data migration, and training? | Provides a realistic understanding of the long-term investment and prevents unexpected future expenses. |

Common Pitfalls in the Software Selection Process

Even with a clear framework, it is easy to fall into common traps during the selection process. Being aware of these pitfalls can help you make a decision that serves your business for years to come, rather than one you quickly outgrow.

- Prioritizing Low Cost Over Security: The cheapest option is rarely the best. Low-cost software often compromises on essential security features and lacks the scalability to support your growth, leading to higher costs in the long run when you are forced to migrate.

- Being Dazzled by a Flashy Interface: A modern user interface is appealing, but it should never overshadow the importance of the underlying security architecture. A beautiful dashboard is worthless if the data behind it is vulnerable.

- Excluding End-Users from the Evaluation: Your accounting team will use this software every day. Failing to involve them in the decision-making process can lead to selecting a platform that is a poor fit for their practical needs, causing frustration and reducing productivity.

- Focusing Only on Current Needs: Choosing a solution that only solves today’s problems is a short-sighted mistake. Select a platform that can scale with your transaction volume, user base, and future international expansion.

Ultimately, selecting a secure accounting software for business is a long-term strategic investment. We believe that transparency is paramount. Look for providers that are open about their security protocols and privacy commitments, as we detail on our website. This clarity is the first sign of a trustworthy partner.