Securing Global Payroll in a Multi Currency World

The New Imperative for Privacy in Global Payroll

As global workforces became the norm over the last decade, the attack surface for sensitive employee data expanded exponentially. We can all picture the sprawling spreadsheet with names, salaries, and bank details distributed across different countries. This makes payroll privacy a core business strategy, not just a compliance checkbox. The conversation has moved far beyond simple password protection.

Today’s risks are sophisticated and highly targeted. We’re not just talking about random malware. Think about ransomware that specifically encrypts payment data right before payday, or a phishing email so convincing it tricks a finance manager into rerouting a senior executive’s salary. The consequences of such a breach are immediate and severe. It’s not only about the potential fines under regulations like GDPR, which can be crippling. It’s about the fundamental loss of employee trust. How can you expect loyalty from a team whose most personal information you failed to protect?

This shift is also driven by employee expectations. People are more aware of their data rights than ever before. They expect their employer to be a responsible steward of their information. Failing to meet this expectation is no longer just a legal liability; it’s a reputational disaster that can undermine company culture from the inside out. Effective global payroll compliance strategies are therefore not just about avoiding penalties, but about upholding a duty of care to your team.

Core Capabilities of a Privacy-First Payroll Platform

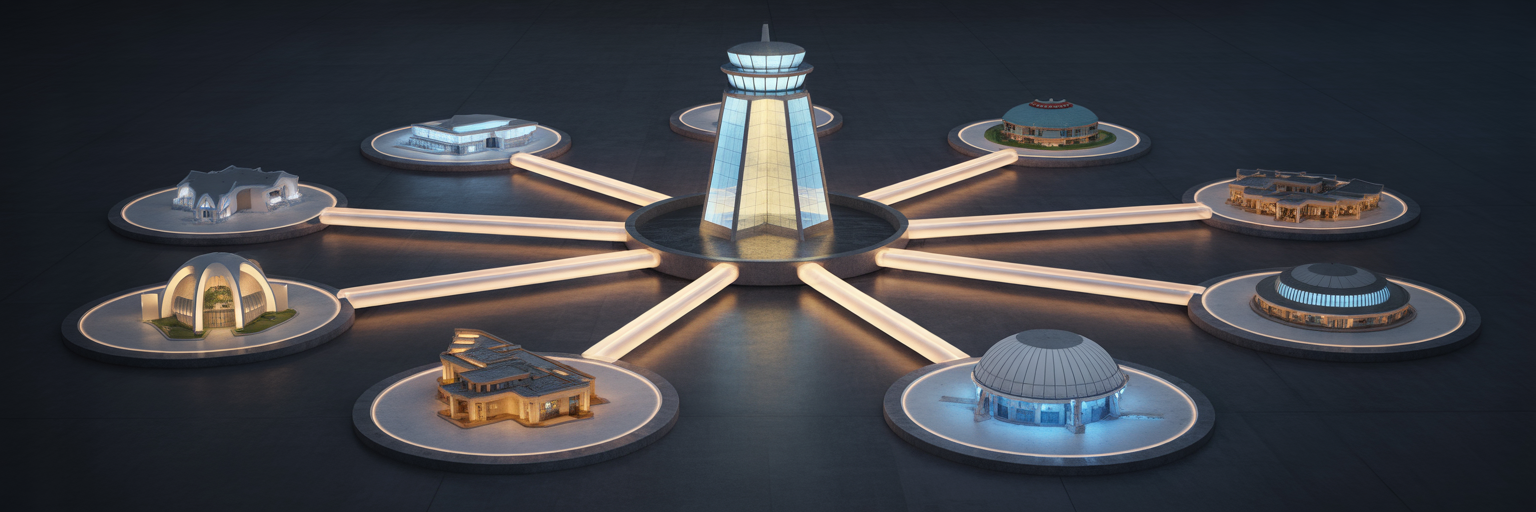

With the stakes so high, the natural question is what a truly secure system looks like. It starts with platforms built on a “privacy by design” philosophy, where data protection is a foundational principle, not an afterthought. Modern systems are engineered from the ground up for security, with platforms like our Zerocrat leading the way in integrating these core privacy capabilities.

End-to-End Encryption and Data Tokenization

Encryption is the baseline, but tokenization is what truly secures the data. Think of it this way: instead of passing an employee’s actual bank account number through various systems, the platform replaces it with a unique, non-sensitive token. If a breach occurs and a hacker steals these tokens, they are essentially holding useless placeholders. The actual financial data remains isolated and secure, rendering the breached information worthless.

Automated Compliance and Tax Management

We’ve all seen errors happen during manual data entry. Every time a person copies, pastes, or adjusts payroll data, it creates a potential vulnerability. Automated platforms minimise this human element. By automatically calculating taxes, deductions, and compliance requirements across different jurisdictions, these systems reduce the risk of manual error and ensure data is handled consistently and securely according to local laws.

Granular Access Controls and Immutable Audit Trails

Not everyone in the finance department needs to see the CEO’s salary. Granular, role-based access controls ensure that employees can only view or edit the specific data necessary for their job. Just as important is an immutable audit trail, which creates a permanent, unchangeable record of every single action taken within the system. If a change is made, you know who made it, what they changed, and when. This traceability is non-negotiable for security and audits.

When evaluating multi-currency payroll solutions, a CFO should look for these non-negotiable features:

- Data tokenization, not just standard encryption.

- Automated, jurisdiction-specific tax and compliance updates.

- Strict, role-based access permissions with mandatory multi-factor authentication.

- A complete and unalterable log of all user activities.

Strategic Currency Management and Secure Conversion

Securing the data is one part of the puzzle; securing the money in motion is the other. For any business paying teams in multiple currencies, managing foreign exchange (FX) volatility is a critical challenge. Simply relying on spot conversions on payday is a gamble that can lead to unpredictable costs and confused employees wondering why their paycheque varies each month. Advanced strategies are needed for stable and secure cross-border payroll processing.

Modern platforms offer tools like automated hedging or the ability to lock in exchange rates for a set period, bringing predictability to your payroll budget. Furthermore, they often bypass the traditional correspondent banking system (SWIFT), which can be slow and involves multiple intermediary banks, each representing a potential point of failure or data exposure. Instead, they use multi-currency digital wallets or direct local payout networks to reduce the number of hands touching the transaction.

This approach also enhances transparency. When an employee sees the exact exchange rate and any fees applied directly within their payslip, it builds trust. Hidden fees and opaque conversion rates do the opposite. Beyond hedging, some organisations explore secured financial solutions for managing payroll risks to guarantee liquidity for their global payroll obligations, regardless of market conditions. Finally, the transaction process itself must be fortified with secure API integrations for connecting to other financial systems and real-time fraud monitoring that can flag and halt suspicious payments before they are executed.

Integrating EORs and Local Providers for Enhanced Security

As companies expand, they often rely on local partners to navigate complex labour laws and payroll regulations. This is where employer of record payroll services become a strategic asset. An Employer of Record (EOR) is a third-party organisation that acts as the legal employer in a specific country, assuming responsibility for payroll, taxes, and compliance. This model creates a crucial privacy buffer, shielding the parent company from direct exposure to local regulatory risks.

However, this strategy is only as strong as the partners you choose. Vetting them on their security posture is essential. This is where a “centralized control, decentralized execution” model works best. Your central, privacy-first platform provides oversight and a single source of truth, while the vetted EORs handle compliant execution on the ground. As outlined in comprehensive resources like Deel’s global payroll buyer’s guide, thoroughly evaluating a potential partner’s security certifications and data protection protocols is a non-negotiable step. Without secure, robust APIs connecting your central platform to these local partners, you risk creating insecure data silos and relying on risky manual transfers like emailing spreadsheets.

| Criterion | What to Look For | Why It Matters for Privacy |

|---|---|---|

| Security Certifications | SOC 2 Type II, ISO 27001, GDPR/CCPA compliance statements. | Provides third-party validation of robust security controls and processes. |

| Data Encryption Standards | End-to-end encryption for data in transit and at rest (e.g., AES-256). | Ensures that even if data is intercepted or breached, it remains unreadable. |

| Access Control Policies | Strict role-based access controls and multi-factor authentication (MFA). | Prevents unauthorized employees from accessing sensitive payroll information. |

| Incident Response Plan | A documented and tested plan for handling data breaches. | Demonstrates preparedness to mitigate damage and notify clients quickly. |

| Data Residency & Sovereignty | Clear policies on where data is stored and processed to meet local laws. | Guarantees compliance with country-specific regulations on data location. |

Emerging Technologies Shaping Secure Payroll

While the strategies above address today’s challenges, the tools for secure cross-border payroll processing are continuously advancing. Several emerging technologies are poised to add new layers of security and transparency to the payroll function.

First, private, permissioned blockchains offer the potential for a completely immutable and tamper-proof ledger of all payroll transactions. Unlike public cryptocurrencies, these are closed systems where every entry is cryptographically signed and verified, creating a perfect audit trail that cannot be altered retroactively. This dramatically enhances integrity and simplifies audits.

Second, AI-driven threat detection is becoming more sophisticated. These systems learn the normal patterns of your payroll and can proactively identify anomalies. For instance, AI could instantly flag a payment being sent to a new, unverified bank account or from a suspicious IP address, alerting administrators to a potential account takeover before funds are disbursed.

Finally, we are moving toward a future of greater employee data sovereignty. Secure self-service portals, built on privacy-first accounting platforms, will empower individuals to manage their own data, update their details, and grant or revoke consent for data usage directly. While these technologies are promising, their adoption faces hurdles. Blockchain for payroll is still in its early stages, and AI models require careful implementation to avoid bias. Nonetheless, they signal the direction of an even more secure and transparent payroll ecosystem.