How to Use Real Time Analytics for Multi Currency Budget Forecasting in 2025

The Strategic Shift in Financial Forecasting

The annual budget, once a cornerstone of corporate finance, often feels like a historical document before the first quarter even ends. In a global economy, currency fluctuations can render a meticulously planned budget irrelevant overnight. This isn’t just an inconvenience; it’s a strategic vulnerability. The core issue is that traditional forecasting forces teams to react to outdated information, like trying to navigate a highway by looking only in the rearview mirror.

This is why the conversation is shifting toward real-time financial analytics. This isn’t merely a new technology but a fundamental change in business philosophy. It’s about moving from a reactive posture of reviewing historical data quarterly to a proactive one of anticipating and responding to market shifts as they happen. This agility is no longer a luxury for companies engaged in multi-currency budget forecasting.

Instead, it has become a critical competitive differentiator. The ability to see financial impacts instantly allows for superior currency risk management and faster capitalisation on favourable market movements. When your competitors are still compiling last month’s reports, your team is already adjusting strategy based on live data. That is the new standard for financial leadership.

Core Technologies Powering Modern Forecasting

Making this strategic shift from reactive to proactive management depends on a specific set of core technologies. The engine driving modern forecasting is artificial intelligence. As explained by experts at NetSuite, AI in financial forecasting uses advanced algorithms to process vast, complex datasets, uncovering patterns that are simply invisible to human analysts. It can identify subtle correlations between market events and currency performance, turning raw data into predictive insight.

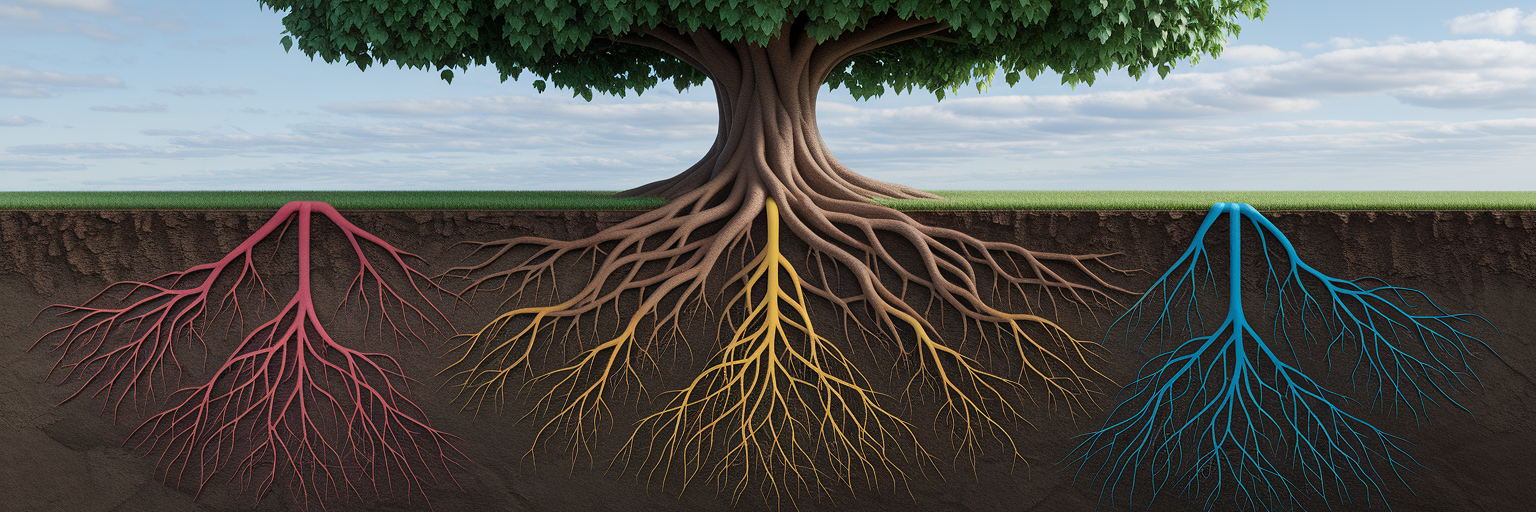

However, AI is only as good as the data it receives. This is where seamless data integration becomes essential. For real-time financial analytics to function properly, platforms must connect directly to ERPs, CRMs, and data warehouses. This creates a single source of truth, eliminating the manual data entry and spreadsheet consolidation that introduce errors and delays. Think of it as creating a central nervous system for your company’s financial data.

In the past, such powerful capabilities were reserved for the largest enterprises. Today, cloud-native platforms have democratised access to these tools. By operating on the cloud, these solutions offer a lower total cost of ownership and greater scalability, making advanced forecasting accessible to ambitious mid-sized organisations ready to compete on a global scale.

Taming Currency Volatility with Dynamic Forecasts

The true test of these technologies lies in their practical application to a persistent challenge: currency volatility. The old method of setting a single, static exchange rate for an entire budget year is a recipe for significant, unexpected variances. For example, a 5% drop in a key currency could wipe out the profit margin on an entire product line, a shock that teams would only discover at the end of the quarter.

Dynamic forecasting models change this entirely by using live forex data. Instead of a fixed rate, the budget is a living document that reflects market reality. This is complemented by automated variance analysis, where AI-powered agents monitor transactions in real time. The moment a significant deviation from the forecast occurs, the finance team is alerted, allowing them to investigate and act immediately, not weeks later.

This proactive stance is most powerful when combined with ‘what-if’ scenario planning. This is a crucial element of how to manage currency risk effectively. With a dynamic model, a CFO can instantly ask, “What is the impact on our net profit if the Euro strengthens by 3% against the Dollar?” or “How does a 10% drop in the Yen affect our supply chain costs?” These simulations, which once took days of spreadsheet modelling, can now be run in seconds, enabling smarter hedging strategies and robust contingency plans.

| Aspect | Traditional Static Budgeting | Real-Time Dynamic Forecasting |

|---|---|---|

| Exchange Rate Basis | Single, fixed rate set for the entire budget period | Live, continuously updated market exchange rates |

| Variance Analysis | Manual, periodic review (e.g., monthly or quarterly) | Automated, instant alerts on significant deviations |

| Scenario Planning | Slow, manual process requiring spreadsheet modeling | Instant ‘what-if’ simulations for multiple currency scenarios |

| Decision Speed | Reactive; decisions based on outdated information | Proactive; enables immediate strategic adjustments |

This table illustrates the fundamental differences in agility and accuracy between traditional and real-time approaches to managing multi-currency financials.

A Practical Framework for Implementation

Adopting real-time analytics can feel like a monumental task, but a structured approach makes it manageable. Rather than attempting a complete overhaul at once, finance leaders can follow a clear, practical framework to ensure success.

- Start with a High-Impact Pilot Project

Avoid a ‘big bang’ implementation that risks overwhelming your team and budget. Instead, select one specific area where currency volatility causes significant pain. A great starting point is forecasting revenue from a key international market or managing costs from a major overseas supplier. Proving value in a contained, high-impact area builds momentum and makes a stronger case for broader adoption. - Select a Scalable and Budget-Friendly Tech Stack

When choosing tools, look beyond the initial price tag. The total cost of ownership, which includes implementation, training, and maintenance, is a far more important metric. Prioritise platforms with proven integration capabilities with your existing ERP and a scalable architecture that can grow with your business. This phased approach is not only manageable but also cost-effective. As reported by SR Analytics, choosing a modern, budget-friendly tech stack can result in a 60-80% lower total cost of ownership compared to legacy enterprise solutions. - Establish Clear KPIs to Measure Success

How will you know if the project is successful? This question must be answered before you begin. Define clear, measurable key performance indicators (KPIs) that are tied to tangible business outcomes. Examples include goals like “reduce forecast variance by 15% within six months” or “cut time spent on manual variance analysis by 50%.” These metrics provide a clear benchmark for success and demonstrate the ROI to stakeholders.

Overcoming Common Implementation Hurdles

While the benefits are clear, it is important to acknowledge the real-world challenges of implementation. Acknowledging these hurdles from the start is the best way to navigate them successfully.

- Data Quality and Integration

The old adage ‘garbage in, garbage out’ is especially true for analytics. The success of any dynamic forecasting model depends entirely on clean, consistent, and reliable data. Before you even think about AI models, you must allocate time and resources for data cleansing and building robust integration pipelines. This foundational work is not glamorous, but it is non-negotiable. - Cost and Resource Commitment

While modern cloud solutions are more affordable than their predecessors, they are not free. There will be costs for the technology, implementation support, and potentially new talent with analytical skills. A transparent and compelling business case, highlighting the costs of inaction, is essential to secure the necessary budget and stakeholder buy-in. - Cultivating a Data-Driven Culture

This is often the most critical and overlooked hurdle. The technology is only half the battle. For real-time analytics to deliver value, the finance team must evolve from being historical reporters to forward-looking strategic advisors. This requires a cultural shift, an investment in training on data interpretation, and a commitment from leadership to empower data-informed decision-making across the organisation.

The Future of Intelligent Financial Planning

Looking ahead, the evolution of financial planning is moving beyond simply predicting outcomes. The next frontier is prescriptive budget allocation, where AI doesn’t just forecast a currency swing but also recommends optimal resource shifts across business units to mitigate risk or seize opportunity. This level of intelligence is transforming financial strategy from a periodic exercise into a continuous, dynamic process.

Enabled by the constant flow of data from real-time systems, rolling forecast implementation is quickly becoming the new operational standard, making the annual budget truly a thing of the past. We are also seeing the emergence of advanced techniques like product clusterization. Here, algorithms group new products with existing ones based on shared sales patterns, dramatically improving forecast accuracy for launches in new international markets.

The ultimate goal is to create more autonomous systems that not only forecast but also recommend strategic actions, freeing up finance teams to focus on high-value business partnering. For organisations ready to embrace this future, the next logical step is to explore platforms designed to deliver these advanced capabilities. You can learn more about how modern solutions are making this a reality by exploring platforms like Zerocrat.