Streamlining Global Commerce with Multi Currency Billing

The New Standard for Global Financial Operations

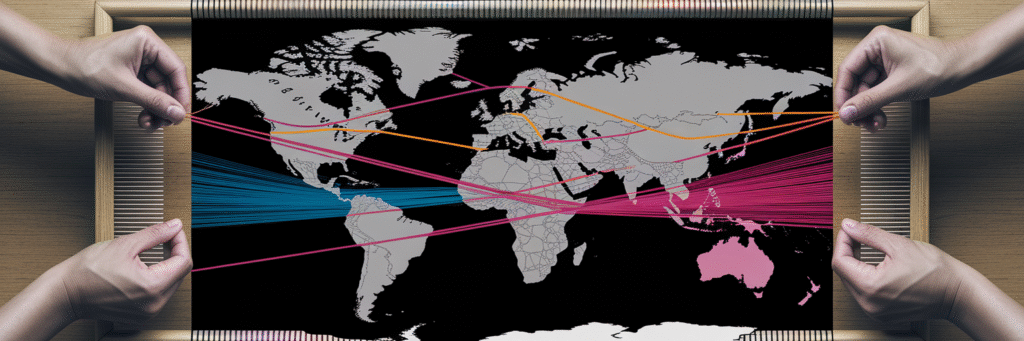

The digital economy has effectively erased many traditional borders, turning even small and medium-sized enterprises into global entities from their first day of operation. This shift introduces immediate and complex financial realities. For any business operating internationally in 2025, multi-currency accounting is no longer a luxury feature for large corporations but a foundational necessity.

Relying on single-currency systems for international transactions creates significant friction. We can all picture the tedious manual entry of daily exchange rates, a task ripe for human error. Then comes the nightmare of reconciling accounts across different currencies, where mismatched numbers can obscure a company’s true financial health. The resulting reports are often inaccurate, painting a distorted picture of performance and making strategic planning feel like guesswork.

Missed opportunities and flawed decisions often stem from this underutilised financial data. Modern customizable billing solutions are the strategic response to these challenges. They are not just about convenience; they are essential tools for achieving accuracy, operational efficiency, and the clear financial oversight needed to compete on a global scale.

Core Capabilities of Advanced Multi-Currency Platforms

Moving beyond the problems of manual accounting, it is important to understand what modern platforms actually do. The core capabilities of today’s multi-currency accounting software are designed to replace guesswork with precision, transforming financial operations from a reactive chore into a strategic asset.

Automated Exchange Rate Updates

Instead of tasking a team member with manually looking up and entering currency values, these platforms connect directly to trusted financial data providers. This integration pulls in real-time exchange rates automatically, ensuring every transaction is recorded with up-to-the-minute accuracy. It eliminates a tedious, error-prone task and provides a reliable basis for all financial reporting.

Dynamic Currency Revaluation

At the end of any accounting period, the value of foreign currency assets and liabilities needs to be adjusted to reflect current exchange rates. This process, known as automated currency revaluation, is a complex and high-risk task when done with spreadsheets. Modern systems perform these calculations automatically, ensuring financial statements are accurate, compliant, and provide a true representation of the company’s financial position.

Customizable Invoicing and Reporting

Serving a global customer base means communicating with them on their terms. This includes sending invoices in their local currency with region-specific formatting. Advanced platforms offer the flexibility to create dynamic invoice templates that adapt automatically. More importantly, they consolidate data from all currencies into a single, coherent view. With tools like the ones offered by advanced multi-currency platforms, finance teams can generate unified reports, giving leadership a clear and immediate understanding of the entire business.

| Capability | Traditional Method (Manual & Error-Prone) | Modern Solution (Automated & Accurate) |

|---|---|---|

| Exchange Rate Management | Daily manual lookup and data entry | Real-time, automated rate synchronization |

| End-of-Period Revaluation | Complex spreadsheet calculations; high risk of error | Automated adjustment of foreign currency assets/liabilities |

| Global Invoicing | Separate templates for each currency; manual adjustments | Dynamic templates with local formatting and currency |

| Financial Reporting | Manual consolidation of disparate reports; delayed insights | Unified, real-time dashboard with consolidated metrics |

This table contrasts the manual, high-risk methods of traditional accounting with the automated, accurate capabilities of modern multi-currency platforms. The data points reflect common operational workflows for finance teams.

AI and Automation in Cross-Border Transactions

Understanding the features of a modern billing system is one thing, but appreciating how its underlying technology drives efficiency is another. Artificial intelligence and automation are not just about doing things faster; they are about doing them smarter. For instance, AI-powered algorithms can analyse market trends to suggest the most opportune times for currency conversion, helping businesses proactively reduce foreign exchange fees rather than just reacting to them.

Automation also directly addresses the complexities of regulatory compliance. Standards like ASC 606 and IFRS 15 require systematic revenue recognition, a process that becomes incredibly complicated across multi-currency contracts. By automating these rules within integrated financial workflows, businesses can ensure compliance without the manual burden, freeing up finance teams from painstaking oversight.

The impact of automation on the finance department is direct and measurable:

- Reduced Manual Errors: Eliminates human error in data entry and reconciliation, leading to more reliable financial data.

- Lower Operational Costs: Frees up finance professionals from repetitive tasks to focus on strategic analysis and planning.

- Increased Productivity: Accelerates closing cycles and reporting timelines, providing faster insights for decision-making.

Overcoming Persistent Cross-Border Payment Hurdles

While advanced software solves many problems, it is not a silver bullet. Certain cross-border payment challenges persist, requiring a proactive financial strategy. One of the most significant issues is the hidden costs embedded in international transactions. As noted by industry experts at Convera, navigating FX markups and intermediary bank fees remains a top challenge for businesses.

A purely software-based approach is not enough. Businesses must adopt smarter financial strategies. One powerful technique is creating multi-currency cash pools. This involves centralising funds from different countries into a single hub, allowing a company to net payments internally. For example, revenue earned in euros can be used to pay European suppliers directly, avoiding costly external FX conversions altogether.

Another strategic layer involves integrated treasury management tools. These features, often built into sophisticated billing platforms, provide real-time monitoring of currency exposure. This visibility allows finance teams to use hedging strategies, like forward contracts, to lock in exchange rates and protect cash flow from market volatility. It is a shift from simply processing payments to actively managing financial risk.

Integrating Compliance and Security into Billing Workflows

In global commerce, trust is the ultimate currency. This makes compliance and security non-negotiable elements of any financial workflow. Modern customizable billing solutions are built with risk mitigation at their core, moving beyond simple process automation to embed regulatory frameworks directly into the system. This includes features like built-in calculators for regional taxes such as VAT or GST and adherence to global invoicing best practices.

A critical component of this is the automatic generation of a complete, unalterable audit trail for every transaction. This functions like a sealed, tamper-proof logbook, providing irrefutable evidence for auditors and simplifying reconciliation. Some platforms are even incorporating blockchain technology to enhance security further. By creating an immutable, distributed ledger of payments, blockchain drastically reduces fraud risk and provides a single source of truth that both sender and receiver can trust.

We stand firm in our belief that these integrated security and compliance features are not optional add-ons. They are core components for any business aiming for sustainable global financial management. A platform built on a foundation of trust and regulatory adherence is essential for long-term growth.

The Future of Global Financial Management

Looking ahead, the direction of global finance is toward deeper integration and intelligence. The trend of hyper-automation is creating seamless, API-driven ecosystems that connect billing, banking, and ERP systems. This facilitates true end-to-end automation, where a transaction flows from invoice to reconciliation without manual intervention. At the same time, ongoing regulatory harmonisation simplifies commerce but demands that businesses remain vigilant about fee transparency and rule changes.

What does this mean for your business? Success in global commerce is not about finding a single, static tool. It is about building a financial infrastructure that is as agile as your business. Your financial system should be a modular toolkit, not a rigid machine. The key is to choose multi-currency accounting software that can evolve with your operations and the global market.

Ultimately, the right decision is about more than just features. It is a long-term strategic choice. By adopting integrated and scalable financial solutions, you equip your business not just to compete today, but to thrive in the borderless economy of tomorrow.