5 Common Expense Tracking Mistakes and How to Avoid Them

The Association of Certified Fraud Examiners (ACFE) consistently reports that organizations lose an estimated 5% of their revenue to fraud each year, with expense reimbursement fraud being a significant contributor. For businesses, particularly those operating on a global scale where financial intricacies multiply, these are not just abstract figures. They represent eroded profits, compromised compliance, and hindered growth. Effective expense tracking is therefore not a mere administrative task, but a critical defense mechanism and a foundation for sound financial governance, essential for maintaining both fiscal health and operational integrity.

The Hidden Costs of Inaccurate Expense Tracking

It’s easy to dismiss a small data entry error or a slightly miscategorized expense as trivial. However, these seemingly minor inaccuracies can snowball into significant financial problems. Over time, they distort your budget accuracy, leading to flawed profitability assessments and misguided strategic decisions. Think of it like a tiny crack in a dam; initially insignificant, it can eventually compromise the entire structure. This cumulative effect means that what starts as a rounding error could end up costing thousands, or even more, in misallocated resources or missed revenue opportunities.

Beyond the direct financial drain, consider the operational drag. Hours are squandered correcting errors, chasing missing receipts, and reconciling discrepancies. This isn’t just frustrating; it pulls your team away from value-added activities. Delayed reimbursements, a common consequence of inefficient tracking, can also negatively impact employee morale and trust. Furthermore, the risks tied to inaccurate data are serious. Non-compliance with tax laws, a major concern for businesses with international operations, can lead to hefty penalties and legal challenges. Difficulties during audits can damage your company’s reputation. Therefore, meticulous and accurate expense recording is far more than a bookkeeping chore; it’s a strategic imperative for financial stability, operational smoothness, and robust risk management.

Mistake 1: Overlooking Minor Expenditures

Many businesses fall into the trap of thinking small expenses are not worth the effort of tracking. This oversight, however, can lead to significant financial leakage over time, especially for startups or operations running on lean margins.

The ‘Small Leaks Sink Big Ships’ Principle

The psychology here is understandable. A $5 coffee for a client meeting or a $10 parking fee seems inconsequential on its own. Why bother with such small amounts when there are larger invoices to manage? This thinking, however, ignores the cumulative power of these minor costs. For a team of ten, if each person has just one untracked $5 expense per week, that’s $2,600 a year vanishing without a trace. These “small leaks,” if unaddressed, can indeed contribute to sinking the financial stability of a business.

Consequences of Omission

When minor expenditures are consistently overlooked, the immediate result is an understatement of total business expenses. This directly skews profitability calculations, making the business appear more profitable than it truly is. Budget comparisons become unreliable because actual spending is not fully captured. Perhaps more critically, businesses miss out on legitimate tax deductions. Every untracked, eligible expense is a missed opportunity to reduce taxable income, which can be particularly impactful for businesses navigating complex tax environments.

Practical Avoidance Strategies

To combat this common oversight, proactive measures are essential. Consider these business expense management tips:

- Implement a clear company policy: Make it explicit that ‘No expense is too small to record.’ This sets the expectation from the top.

- Encourage the use of mobile expense tracking apps. These tools allow employees to capture receipts and log expenses immediately, on-the-go, reducing the chance of forgetting small purchases.

- Train employees on the importance of prompt submission for all receipts, regardless of their monetary value. Emphasize that comprehensive data benefits everyone.

The Role of Regular Reconciliation

Finally, regular reconciliation of petty cash accounts and company credit card statements is crucial. This process often uncovers those small, easily forgotten expenses that might otherwise slip through the cracks. By diligently matching statements to recorded expenses, you ensure that every expenditure, no matter how minor, is accounted for. This comprehensive tracking is fundamental for maintaining accurate financial oversight and control.

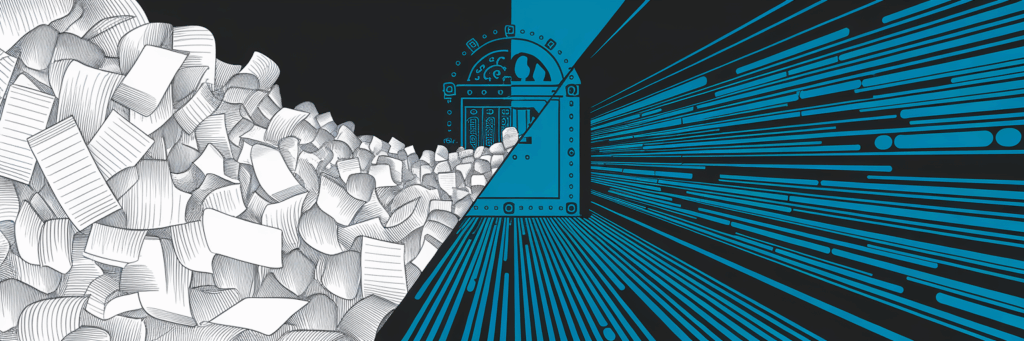

Mistake 2: Relying Solely on Manual Input Methods

In an era where digital precision is paramount, clinging to manual expense input methods is like navigating a modern highway with a horse and buggy. It’s not just slow; it’s fraught with risks that can undermine your financial data’s integrity and operational efficiency.

The Inherent Risks of Manual Data Entry

Human beings, no matter how diligent, are prone to error. When employees or accounting staff manually type numbers from receipts into spreadsheets or ledgers, mistakes like typos, transpositions (e.g., entering $83 instead of $38), or incorrect calculations are almost inevitable. Each error, even a small one, directly impacts data integrity. These inaccuracies can then ripple through financial reports, leading to flawed analyses and potentially costly business decisions based on incorrect information. Imagine the frustration of basing a budget on figures that are later found to be inaccurate due to a simple data entry slip.

Time Inefficiency and Productivity Loss

The time drain associated with manual expense tracking is substantial. Employees spend valuable hours collecting paper receipts, filling out forms, and submitting them. Accounting teams then dedicate further time to manually entering this data, verifying it, and processing reimbursements. This entire paper trail is labor-intensive and diverts skilled personnel from more strategic tasks like financial analysis or planning. This isn’t just an inconvenience; it’s a direct hit to productivity across the organization.

Lack of Real-Time Visibility

Manual systems, by their very nature, involve delays. Expenses are often recorded days, or even weeks, after they occur. This lag means that financial data is rarely current, hindering agile decision-making. For businesses operating in dynamic global markets, where quick responses to changing conditions are critical, this lack of real-time visibility into spending can be a significant competitive disadvantage. You cannot steer a ship effectively if your map is always outdated.

Transitioning to Automated Solutions

The clear path forward is to improve financial tracking by embracing automation. Modern expense management software offers a suite of tools designed to overcome the limitations of manual processes. Technologies like Optical Character Recognition (OCR) can automatically scan and extract data from receipts, drastically reducing manual entry. Direct integrations with bank and credit card feeds ensure transactions are captured promptly and accurately. Comprehensive platforms can streamline the entire workflow, from submission to approval and reimbursement. For businesses prioritizing data protection, solutions offering features like encrypted receipt uploads align perfectly with a privacy-first accounting approach, ensuring sensitive financial data is handled securely. Automation is no longer a luxury; it’s a cornerstone of accurate, efficient, and secure financial management.

| Aspect | Manual Expense Tracking | Automated Expense Tracking |

|---|---|---|

| Data Accuracy | Prone to human error (typos, miscalculations), difficult to verify. | Significantly higher due to reduced manual input, automated validation. |

| Time Efficiency | Labor-intensive, slow processing for employees and finance teams. | Streamlined workflows, rapid data capture (e.g., OCR), faster reimbursements. |

| Real-Time Visibility | Delayed data entry leads to outdated financial picture. | Instant data availability, enabling timely financial insights and decisions. |

| Security & Compliance | Physical receipts easily lost/damaged; harder to enforce policies consistently. | Secure digital storage (e.g., encrypted uploads), auditable trails, easier policy enforcement. |

| Scalability | Difficult to manage with business growth and increasing transaction volume. | Easily scales with business needs, supports global operations and multiple currencies. |

Mistake 3: Vague Categorization and Insufficient Detail

One of the most common expense tracking errors involves using ambiguous categories or failing to provide enough detail for each transaction. This might seem like a minor shortcut, but it significantly hampers your ability to understand and control spending.

The Problem with Ambiguous Categories

When expenses are lumped into overly broad categories like “Miscellaneous,” “General Supplies,” or “Travel,” it’s like trying to understand a complex painting by looking at it through a fogged-up window. You get a general idea, but the crucial details are lost. Such generic labels obscure true spending patterns, making it nearly impossible to identify where money is actually going. Is “Miscellaneous” hiding a series of small software subscriptions, unexpected repair costs, or client entertainment? Without clarity, you cannot know.

Impact on Financial Reporting and Analysis

This lack of specificity directly undermines the utility of your financial reports. Meaningful departmental budget control becomes a challenge because you cannot accurately attribute costs. Analyzing spending by cost center or project becomes guesswork. Identifying potential areas for savings or cost optimization is extremely difficult when you cannot see the granular detail of expenditures. How can you negotiate better rates with a supplier if you don’t even realize how much you’re spending with them because it’s hidden in a vague category?

Compliance and Audit Trail Weaknesses

From a compliance perspective, vague categorization is a red flag. During an audit, whether internal or external, you need to be able to justify every expense. If an expense is poorly detailed or miscategorized, it becomes difficult to demonstrate its business purpose. This can lead to disallowed deductions by tax authorities, particularly for expenses like meals, entertainment, or travel where specific documentation requirements often apply. A weak audit trail not only creates headaches but can also result in financial penalties.

Establishing Clear Categorization Rules

To avoid these pitfalls, businesses must establish and enforce clear rules for expense categorization and detail. This involves several practical steps:

- Develop a standardized chart of accounts with specific, well-defined, and mutually exclusive categories. Avoid overlap and ensure categories are intuitive for employees.

- Train employees thoroughly on the correct usage of these categories. Provide examples and clear guidelines to minimize confusion.

- Mandate that sufficient descriptive information is provided for each transaction. For example, for a meal expense, require details like the purpose of the meal and the names of attendees. For travel, specify the destination and business reason.

Ultimately, clear, consistent categorization coupled with adequate descriptive detail is vital for generating actionable insights from your financial data and maintaining robust compliance.

Mistake 4: Procrastinating on Expense Recording

Delaying the recording of expenses is a common habit, yet it’s one that can quietly sabotage your financial accuracy and control. The longer you wait, the more challenging it becomes to ensure complete and precise data.

The ‘Out of Sight, Out of Mind’ Danger

It’s human nature to postpone tasks that seem tedious. After a busy day or a long business trip, the last thing many want to do is sift through receipts and log expenses. This “I’ll do it later” mentality often leads to expenses being forgotten altogether or receipts getting lost. A receipt crumpled in a pocket or an email confirmation buried in an inbox can easily slip from memory if not dealt with promptly. This is the classic ‘out of sight, out of mind’ danger, where unrecorded expenses accumulate, leading to an incomplete financial picture.

Accuracy Degradation Over Time

Even if an expense isn’t completely forgotten, memory fades. The longer the delay between incurring an expense and recording it, the harder it becomes to recall crucial details. What was that $50 charge for? Who attended that client dinner? Why was that particular software purchased? Without timely recording, these specifics can become hazy, leading to inaccurate categorization or insufficient justification. This degradation of accuracy compromises the quality of your financial data, making reliable analysis difficult.

Cash Flow Mismanagement and Budgeting Issues

Procrastination in expense recording directly impacts your ability to manage cash flow effectively. If expenses aren’t logged promptly, your accounting system reflects an outdated and overly optimistic view of your available cash. This can lead to overspending, as decisions are made based on incomplete information. Budgeting also suffers, as forecasts rely on historical data that, if incomplete due to delayed entries, will not accurately reflect true spending patterns. It’s like trying to navigate with a compass that’s consistently a few degrees off; you might not notice small deviations at first, but you’ll eventually find yourself far from your intended destination.

Implementing Timely Recording Habits

Fostering a culture of prompt expense reporting is key. Encourage employees to make accurate expense recording a regular, if not immediate, habit. Implementing daily or weekly reminders can help. Promoting the use of mobile expense tracking apps allows for immediate capture of receipts and details at the point of purchase. Ultimately, the goal is to make timely recording an ingrained part of the workflow, ensuring that financial data is always current, complete, and reliable for informed decision-making and effective cash flow management.

Mistake 5: Disregarding Internal Policies and Tax Regulations

A robust expense tracking system is more than just software and processes; it relies heavily on adherence to established rules, both internal company policies and external tax regulations. Ignoring these can lead to significant operational and financial repercussions.

The Importance of Internal Expense Policies

Internal expense policies are the bedrock of consistent and fair expense management. They define what constitutes a legitimate business expense, set spending limits, outline approval workflows, and specify documentation requirements. These policies are not arbitrary rules; they are designed to ensure consistency across the organization, promote fairness in reimbursements, and act as a crucial internal control to prevent accidental misuse or deliberate fraud. When everyone understands and follows the same guidelines, the entire process runs more smoothly and transparently.

Consequences of Non-Adherence to Internal Policies

When employees disregard internal policies, it creates a cascade of problems. Claims might be rejected, leading to frustration and dissatisfaction. Managers spend extra time reviewing non-compliant submissions or seeking clarifications. More seriously, inconsistent application or disregard for policies weakens internal controls, potentially opening the door to errors or even fraudulent claims. This can erode trust and create an environment where accountability is diminished. It’s essential to avoid expense report mistakes by ensuring policies are clear and consistently enforced.

Navigating Complex Tax Deductibility Rules

Beyond internal rules, businesses must navigate the often-complex landscape of tax deductibility. Tax authorities worldwide have specific regulations about what expenses are deductible, the level of documentation required, and how they must be reported. These rules can vary significantly by jurisdiction, a particular challenge for global businesses. Failure to comply can result in disallowed deductions, leading to a higher tax burden, and potentially significant penalties and interest charges during an audit. Understanding and applying these rules correctly is non-negotiable for financial health.

Ensuring Robust Compliance Practices

Ensuring compliance requires a multi-faceted approach. Regular employee training on both internal policies and relevant tax regulations is essential. Policy documents should be easily accessible and clearly written. Utilizing accounting systems that are designed to support compliance can be a significant advantage. For instance, platforms built for global operations and prioritizing data integrity can help manage diverse tax rules by allowing custom fields for jurisdiction-specific information or even flagging potentially non-compliant expenses based on predefined rules. Adherence to both internal policies and external tax laws is fundamental for maintaining financial integrity, minimizing risk, and ensuring long-term business sustainability.

Building a Robust Expense Tracking System

Avoiding common pitfalls in expense tracking isn’t about fixing one isolated issue; it’s about building a comprehensive and resilient system. Such a system integrates clear guidelines, diligent practices, and effective tools to ensure financial data is accurate, timely, and secure. This foundation supports better decision-making and overall business health.

The core components of an effective expense tracking system include:

- Clearly defined policies that leave no room for ambiguity regarding what is permissible and how expenses should be reported.

- Thorough employee training to ensure everyone understands these policies and the correct procedures for logging expenses.

- Enforced timely recording practices, encouraging immediate or daily capture of expenditures to maintain data freshness.

- Accurate and detailed categorization, moving beyond vague labels to provide granular insight into spending patterns.

- Regular reviews and reconciliations to catch errors, identify discrepancies, and ensure the integrity of the financial data.

Modern accounting platforms play a crucial role in enabling these components. They offer automation to reduce manual errors, real-time analytics for immediate insights, and advanced security features to protect sensitive financial information. For businesses that place a high value on data privacy, platforms incorporating features like a zero-knowledge architecture offer an exceptional level of security, ensuring that only authorized users can access sensitive data. These are valuable business expense management tips to consider when selecting a solution.

However, tools and processes are only as effective as the company culture that supports them. Fostering an environment of accountability and fiscal responsibility is paramount. Expense tracking should not be viewed as a burdensome chore but as a strategic asset—an evolving system that requires continuous improvement to adapt to new business needs and emerging technologies. When managed effectively, it provides the clarity needed for informed decisions and sustainable success.